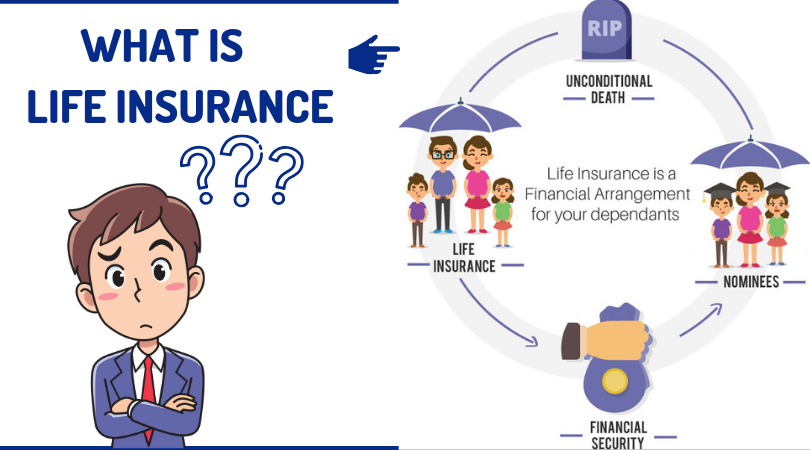

Life insurance is a contract between an individual (the policyholder) and an insurance company. In exchange for regular payments, known as premiums, the insurer agrees to pay a designated sum (the death benefit) to the policyholder's beneficiaries when the policyholder dies.

The primary goal of life insurance is to provide financial protection for dependents or loved ones after the policyholder's death. This money can be used for various purposes, such as covering funeral costs, paying off debts, or ensuring the family's financial security.

How Does Life Insurance Work?

The basic workings of life insurance involve three key elements:

Premiums :

- The policyholder pays a premium, which can be paid monthly, quarterly, or annually, to keep the policy active.

- The amount of the premium depends on several factors, including the policyholder's age, health, the amount of coverage, and the type of policy.

Death Benefit :

- The death benefit is the lump sum paid out to the beneficiary upon the policyholder's death.

- The amount is predetermined when the policy is purchased, and it can range from a few thousand dollars to millions, depending on the policy.

Beneficiaries :

- The beneficiaries are the individuals or entities that the policyholder designates to receive the death benefit. These could include family members, friends, or even charitable organizations.

Types of Life Insurance

There are two main types of life insurance: term life insurance and permanent life insurance .

1. Term Life Insurance

- Coverage Duration : Term life insurance provides coverage for a specified period, such as 10, 20, or 30 years.

- Simpler and More Affordable : It is usually more affordable than permanent life insurance, as it only covers a limited time.

- No Cash Value : Term life policies do not accumulate cash value. If the policyholder outlives the term, no benefit is paid, and the policy expires.

- Best For : Individuals seeking affordable, temporary coverage, particularly those with dependents or significant financial obligations.

2. Permanent Life Insurance

- Lifetime Coverage : Permanent life insurance, as the name suggests, provides coverage for the policyholder's entire life as long as premiums are paid.

- Cash Value Component : This type of insurance includes a savings or investment component called cash value, which grows over time and can be borrowed against or used to pay premiums.

- More Expensive : Due to the lifetime coverage and cash value feature, permanent life insurance is typically more expensive than term life insurance.

- Subtypes : Permanent life insurance comes in various forms, such as whole life and universal life insurance , each with unique features.

Why Is Life Insurance Important?

Life insurance plays a critical role in financial planning, especially for individuals with dependents or significant financial commitments. Here are a few reasons why it might be necessary:

- Financial Protection for Dependents : Life insurance provides a safety net for your loved ones, helping to replace lost income and ensuring their financial stability.

- Paying Off Debts : The death benefit can be used to settle outstanding debts like mortgages, loans, or credit card balances, preventing your family from bearing the burden.

- Funeral Expenses : Funeral costs can be a significant financial strain on families. Life insurance can help cover these expenses, relieving your loved ones from additional stress.

- Estate Planning : Life insurance can also be a valuable tool in estate planning, ensuring that your heirs receive an inheritance or helping cover estate taxes.

- Business Continuity : For business owners, life insurance can be structured to fund business succession plans, ensuring a smooth transition of ownership.

How to Choose the Right Life Insurance Policy

Selecting the right life insurance policy requires careful consideration of your financial situation, life stage, and goals. Here are a few factors to consider:

- Evaluate Your Needs : Calculate how much coverage you need by considering your debts, income, dependents, and future financial obligations (such as college tuition).

- Choose the Right Type : Decide whether term life or permanent life insurance is more appropriate based on how long you need coverage and your budget.

- Compare Policies : Shop around and compare policies from different insurers, focusing on the premium costs, benefits, and any additional riders (eg, critical illness coverage).

- Health Considerations : Many life insurance policies require a medical exam or questionnaire to assess your health risks. If you have existing health conditions, this might affect your premium.

- Review Regularly : Life circumstances change, and so might your insurance needs. It's essential to review your policy periodically to ensure it still aligns with your goals.

Conclusion

Life insurance is a crucial tool for the financial well-being of your loved ones in the event of your death. Whether you choose ensuring term life for temporary coverage or permanent life insurance for lifelong protection, the key is to evaluate your individual needs, goals , and financial situation. By selecting the right life insurance policy, you can provide peace of mind for yourself and your family, knowing they will be financially protected during difficult times.What is Term Life Insurance

Term life insurance is a type of life insurance policy that provides coverage for a specific period or "term," such as 10, 20, or 30 years. If the policyholder dies during the term, the insurance company pays a death benefit (a lump sum of money) to the recipient designated by the policyholder. If the policyholder outlives the term, the coverage expires, and no death benefit is paid unless the policy is renewed or converted to a permanent policy.

Key Features of Term Life Insurance

Fixed Duration of Coverage :

- Unlike permanent life insurance, term life policies are designed to last for a set number of years. Common terms range from 10 to 30 years.

- The policyholder can choose the length of the term based on their needs, such as until their children are financially independent or their mortgage is paid off.

Affordable Premiums :

- Term life insurance is generally more affordable than permanent life insurance because it offers coverage for a limited time and doesn't include a savings or investment component.

- Premiums are typically fixed for the length of the term, meaning they won't increase as long as the policy remains active.

Death Benefit :

- The death benefit is the amount paid to the beneficiary if the policyholder dies during the term.

- Beneficiaries can use the payout for various needs, such as covering funeral expenses, paying off debts, or providing financial support.

No Cash Value :

- Term life insurance does not accumulate cash value or savings over time. Once the term ends, the policy has no residual value unless renewed.

Renewal and Conversion Options :

- Some policies offer the option to renew at the end of the term, usually at a higher premium, or convert the policy to a permanent life insurance policy.

- These options provide flexibility if your financial needs change as you get older.

Why Choose Term Life Insurance?

Term life insurance is an excellent choice for individuals seeking affordable, temporary coverage to protect their family during specific stages of life, such as:

- Income Replacement : To provide financial support for dependents if the policyholder passes away while still earning an income.

- Debt Coverage : To cover major debts like a mortgage, student loans, or car loans.

- Family Support : To ensure that children's education, living expenses, or future needs are covered.

- Short-Term Financial Goals : It aligns with specific financial goals or obligations that have a clear end date.

Conclusion

Term life insurance offers a simple, cost-effective way to provide financial protection for your loved ones during a set period. It's ideal for those seeking temporary coverage to secure their family's financial future without the higher costs associated with permanent life insurance.